When you walk into a Dollar Financial Group payday location in a strip mall in California, the view is not much different from the one you’d find in Spain, London, or Toronto. There’s a spartanly furnished lobby, a line of protective glass windows above a long teller counter, a table for filling out Western Union paperwork, and a secure employee entrance.

The sameness is intentional, a hallmark of Dollar Financial Group’s “store-in-the-box” program, which aggregates all building materials in one location, flat-packs and condenses them, and then ships them directly to each construction site for assembly.

Brian McAndrews, senior vice president of global real estate and construction at Dollar Financial Group, says the uniform construction approach helps enhance security. “The security components of what we build are pretty universal,” he says. “Many of our security features are highly visible. Our goal is to provide a comfortable environment to conduct business while keeping employees, customers, and assets protected.”

The $1 billion global financial-services firm provides unbanked and under-banked consumers with unsecured short-term consumer loans, pawn loans, check cashing, money transfers, gold buying, and other ancillary services. To mitigate the risks associated with high-frequency money transferring, all Dollar Financial Group locations have conspicuous security measures.

The store-in-the-box program, in addition to standardizing the selection and installation of security components, also cuts costs and quickens the pace at which Dollar Financial Group can leverage capital to open new stores. The company operates approximately 1,560 stores around the world, including 255 stores in the United States under primarily the Money Mart and Check Cashing Store brands. It also grows its portfolio by acquiring portions of the portfolios of former competitors (including the Cash Store in Canada), remodeling the stores in just two to three weeks (typically for about $150,000-200,000), and reopening them for business. Recently, the company made acquisitions in Poland, Romania, and Scandinavia.

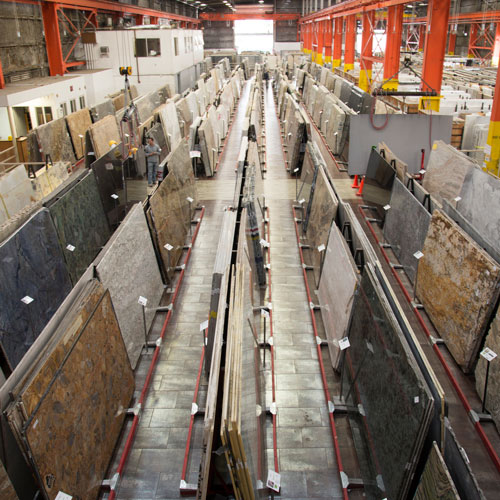

Operationally, the store-in-the-box program is fairly simple. Third-party contractors such as Shaw Woodworking, 360 Construction, Cornerstone, and Mirabelle supply standardized construction components, including ceiling tiles, cash trays, flooring, and millwork for counters, partitions, and bulkheads. Orders are filled on demand, and the parts and components typically leave the warehouse within 48 hours of an order, flat-packed and ready for installation. Contractors are responsible for arranging shipping to the construction site so that everything arrives the moment renovation is set to begin. “It’s pick and pack from the warehouse,” McAndrews says. “Everything is like IKEA: flat boxes and screw-and-glue assembly on-site.”

—Brian McAndrews

SVP of Global Real Estate

and Construction

When the company and its partners can find strategic ways to cut costs and construction time, they will. Shaw Woodworking, for instance, recently devised a change in a bullet-resistant glass housing, replacing a bracket assembly with a grooved, slide-in frame that has quickened the pace of construction and is being broadly replicated across Dollar Financial Group’s portfolio.

The company is rarely the first tenant in a space; its locations are almost always built into 1,200- to 1,400-square-foot storefronts in strip malls and grocery-anchored shopping centers and along major city boulevards. The stores are leased, and if any remnants can be spared and repurposed from a previous tenant—flooring, lighting, ceiling tiles—they are. “The greatest challenge is that nobody ever buys or develops retail property hoping someday they will put a check casher in it,” McAndrews says. “From a transaction standpoint, this is the most difficult job I’ve ever had. For most other businesses, landlords embrace tenancy. That’s not the case here. We occasionally need to educate a landlord as to the quality of our operations in order to secure a good location.”

Once new stores are acquired, they must be closely managed. And, as one can imagine, monitoring the lease utilization of an international portfolio of more than 1,500 stores with a team of just 20 full-time employees is not easy. McAndrews credits Harbor Flex’s automated database-management platform, Lease Harbor, with helping him run complex rent, assessment, insurance, and tax calculations from anywhere in the world. “If I’m on a train in Spain, I can look up information on our office in central Warsaw,” McAndrews says. “This allows me to manage the business very strictly and catch rent increases and improper tax and utility fees.”

That’s not the only aspect of the business that McAndrews and his team scrutinize closely to save dollars, either. Shipping, labor, and production costs are priced by country and region to determine whether it’s cheaper to source products locally or transport them across distances. Millwork and lighter furniture, for example, often can be acquired and shipped inexpensively, which is why McAndrews may choose a Polish manufacturer for a job in Sweeden. Safes and vaults, on the other hand—from suppliers such as Gunnebo—are purchased through local networks because their weight makes shipping them cost-prohibitive. “We’re always looking for the low-cost partner,” McAndrews says.